“California is not just a state; it’s an economy unto itself. And real estate? That’s where the magic happens.” – Robert Kiyosaki, Author of Rich Dad Poor Dad

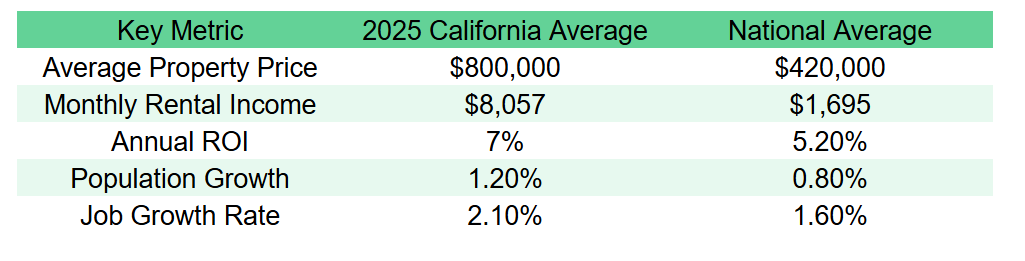

California’s real estate market continues to captivate investors worldwide, and for good reason. With average property prices around $800,000 and rental income averaging $8,057, investors can expect a solid 7% ROI in the Golden State. But success in California real estate investing requires more than just capital. It demands strategy, market knowledge, and timing.

Why California Real Estate Investing Remains a Golden Opportunity in 2025

The Numbers Don’t Lie: California’s Market Strength

California’s real estate market has weathered numerous economic storms and emerged stronger each time. Here’s what makes it particularly attractive for investors in 2025:

Sarah’s Success Story: From First-Time Investor to Portfolio Owner

Meet Sarah Chen, a software engineer from San Jose who started her real estate journey in 2022 with a single duplex in Sacramento. “I was terrified of the high entry costs,” Sarah recalls. “But I focused on cash flow positive properties in emerging neighborhoods.”

Today, Sarah owns 4 properties across California, generating over $18,000 monthly in rental income. Her secret? She capitalized on the remote work trend, investing in suburban properties as demand shifted away from city centers.

5 Strategic Investment Approaches for California Real Estate

1. The Suburban Shift Strategy

Remote work is driving buyers to consider homes farther from city centers, significantly increasing demand in suburban areas. This presents a unique opportunity for investors willing to think beyond traditional metropolitan hotspots.

Best Suburban Markets for 2025:

- Sacramento: Median home price $500,000, 6% annual growth

- Fresno: Median home price $350,000, 5.5% rental yield

- Riverside County: Growing tech presence, 15% year-over-year appreciation

2. The Tech Hub Proximity Play

California’s technology sector continues to drive real estate demand. Orange County leads with a median sales price of $1.18 million and 11.6% year-over-year growth.

Key Tech-Adjacent Markets:

- Mountain View: Close to Google headquarters, consistent rental demand

- Irvine: Orange County’s tech corridor, family-friendly with excellent schools

- San Diego: Emerging biotech hub with more affordable entry points

3. The Multifamily Advantage

California’s multifamily housing market remains one of the strongest investment opportunities for 2025, driven by housing shortages and changing demographics.

Why Multifamily Works in California:

- Higher cash flow potential per investment dollar

- Built-in diversification (multiple rental units)

- Strong appreciation in supply-constrained markets

- Professional management scalability

4. The REIT Diversification Method

For investors seeking California exposure without direct property management, Real Estate Investment Trusts (REITs) offer portfolio diversification and market leverage opportunities.

Top California-Focused REITs to Consider:

- Equity Residential (EQR): Large apartment communities

- AvalonBay (AVB): Upscale multifamily properties

- UDR Inc (UDR): Diverse geographic footprint

5. The Value-Add Rehabilitation Strategy

California’s older housing stock presents opportunities for value-add investments through strategic renovations and improvements.

Top 7 Cities for Real Estate Investing in California (2025 Edition)

1. San Diego: The Balanced Play

- Median Home Price: $800,000

- Average Monthly Rent: $2,800 (2-bedroom)

- Key Advantage: Tourism + tech economy stability

- Best For: Long-term appreciation with steady cash flow

2. Sacramento: The Cash Flow King

- Median Home Price: $500,000

- Average Monthly Rent: $2,200 (2-bedroom)

- Key Advantage: Government jobs + Bay Area overflow

- Best For: First-time investors seeking positive cash flow

3. Fresno: The High-Yield Opportunity

- Median Home Price: $350,000

- Rental Yield: 5.5%

- Key Advantage: Agricultural economy stability

- Best For: Investors prioritizing immediate returns

4. San Francisco: The Appreciation Giant

- Median Home Price: $1.5 million

- Average Monthly Rent: $4,000 (2-bedroom)

- Key Advantage: Tech wealth + limited supply

- Best For: High-net-worth investors seeking long-term wealth building

5. Los Angeles: The Entertainment Economy

- Median Home Price: $800,000

- Population Growth: 1.1% annually

- Key Advantage: Diverse economy + global appeal

- Best For: Investors comfortable with market volatility

6. Orange County: The Premium Market

- Median Sales Price: $1.18 million

- Year-over-Year Growth: 11.6%

- Key Advantage: High-income demographics

- Best For: Luxury property investors

7. Riverside County: The Emerging Star

- Key Advantage: Affordability + proximity to major markets

- Growth Potential: High, driven by population migration

- Best For: Investors seeking maximum appreciation potential

4 Critical Challenges Every California Investor Must Navigate

Challenge #1: High Entry Costs

The Reality: California real estate has always dealt with high upfront investments.

The Solution:

- Consider house hacking (live in one unit, rent others)

- Explore FHA loans for owner-occupied properties

- Partner with other investors to pool resources

- Start in more affordable inland markets

Challenge #2: Complex Regulatory Environment

California’s 2025 legislative updates cover resident protections, rent control, property safety, zoning changes, and tax regulations.

Key Regulatory Considerations:

- Rent control laws in major cities

- Tenant protection requirements

- Short-term rental restrictions

- Environmental compliance costs

Challenge #3: Market Volatility

California’s market can experience significant swings based on economic factors, natural disasters, and policy changes.

Risk Mitigation Strategies:

- Diversify across multiple markets

- Maintain adequate cash reserves (6-12 months expenses)

- Consider landlord insurance

- Build relationships with reliable contractors

Challenge #4: Competition from Institutional Investors

Large investment firms increasingly compete for California properties, driving up prices.

Competitive Advantages for Individual Investors:

- Speed in decision-making

- Personal relationships with sellers

- Willingness to purchase properties needing minor repairs

- Local market knowledge

The Smart Money Calculator: Evaluating California Investment Properties

Before investing in any California property, run these essential calculations:

Cash Flow Analysis Formula

Monthly Cash Flow = Gross Rental Income - Operating Expenses

Operating Expenses Include:

• Property Management (8-12% of rent)

• Maintenance & Repairs ($200-500/month)

• Property Taxes (1.25% annually in California)

• Insurance ($100-300/month)

• Vacancy Allowance (5-10% of rent)

• Utilities (if landlord-paid)

Example: Sacramento Duplex Analysis

| Income & Expenses | Monthly Amount |

|---|---|

| Gross Rental Income | $4,400 |

| Property Management | $440 |

| Maintenance Reserve | $300 |

| Property Taxes | $520 |

| Insurance | $180 |

| Vacancy Allowance | $220 |

| Net Operating Income | $2,740 |

The 1% Rule vs. California Reality

The traditional 1% rule (monthly rent = 1% of purchase price) rarely applies in California’s high-value markets. Instead, focus on:

- Cash-on-cash return: 8-12% in good California markets

- Cap rates: 4-6% for stabilized properties

- Appreciation potential: 3-7% annually long-term

6 Essential Steps to Start Real Estate Investing in California

Step 1: Build Your Investment Foundation (Months 1-2)

- Establish investment criteria and goals

- Secure pre-approval for financing

- Build your team (agent, lender, accountant, attorney)

- Research target markets thoroughly

Step 2: Market Analysis and Property Selection (Months 2-4)

- Analyze 3-5 target cities

- Create property evaluation criteria

- Attend local real estate investment meetings

- Build relationships with local real estate agents

Step 3: Financing Strategy Implementation (Month 3)

- Compare conventional vs. portfolio lenders

- Consider private money options

- Evaluate partnership opportunities

- Secure backup financing options

Step 4: Due Diligence and Acquisition (Months 4-5)

- Conduct thorough property inspections

- Analyze local rental markets

- Verify all financial projections

- Negotiate purchase terms

Step 5: Property Management Setup (Month 6)

- Choose between self-management or hiring professionals

- Implement tenant screening processes

- Establish maintenance vendor relationships

- Set up accounting systems

Step 6: Portfolio Growth and Optimization (Ongoing)

- Monitor market conditions regularly

- Reinvest cash flow strategically

- Consider refinancing opportunities

- Plan for portfolio expansion

Financing Your California Real Estate Investment: 5 Proven Methods

1. Conventional Investment Property Loans

- Down Payment: 20-25% typically required

- Interest Rates: 0.5-1% higher than owner-occupied

- Best For: Traditional investors with good credit

2. Portfolio Lenders

- Advantage: More flexible underwriting

- Consideration: Often local or regional banks

- Best For: Experienced investors with multiple properties

3. Hard Money Lending

- Timeline: 7-14 days to close

- Cost: Higher interest rates (8-15%)

- Best For: Fix-and-flip or time-sensitive acquisitions

4. Private Money Partners

- Structure: Various partnership arrangements

- Benefit: Access to larger deals

- Best For: Investors with limited capital but strong expertise

5. Home Equity Lines of Credit (HELOC)

- Advantage: Flexible access to capital

- Risk: Your primary residence as collateral

- Best For: Experienced investors with significant home equity

Market Forecast: What to Expect in California Real Estate Through 2025

Economic Indicators to Watch

Current unemployment sits at 5.2%, with San Diego County holding the lowest rate at 4.3%. Available inventory has grown 14% compared to previous quarters, giving investors more options.

Key Trends Shaping 2025:

- Interest Rate Stabilization: Mortgage rates expected to stabilize in the 6-7% range

- Inventory Increases: Housing supply is finally beginning to loosen in some regions

- Suburban Continued Growth: Remote work policies making suburban markets more attractive

- Tech Sector Recovery: Silicon Valley showing signs of employment stabilization

Regional Variations Expected:

- Northern California: Slower growth, focus on value markets

- Southern California: Continued strength in Orange County and San Diego

- Central Valley: Highest growth potential for cash flow investors

- Bay Area: Premium market stabilization with selective opportunities

Tax Advantages: Maximizing Your California Investment Returns

Federal Tax Benefits

- Depreciation: 27.5 years for residential rental property

- 1031 Exchanges: Defer capital gains through like-kind exchanges

- Interest Deductions: Mortgage interest on investment properties

- Operating Expense Deductions: Property management, repairs, insurance

California-Specific Considerations

- Property Tax: Average 1.25% of assessed value

- State Income Tax: High rates make tax planning crucial

- Proposition 13: Limits annual property tax increases to 2%

Advanced Tax Strategies

- Cost Segregation Studies: Accelerate depreciation on commercial properties

- Opportunity Zone Investments: Tax advantages in designated areas

- Real Estate Professional Status: Potential for unlimited loss deductions

Building Your California Real Estate Investment Team

Essential Team Members:

- Real Estate Agent: Choose someone specializing in investment properties

- Mortgage Broker/Lender: Develop relationships with multiple financing sources

- Property Manager: Critical for out-of-state or multiple property owners

- Accountant: Preferably with real estate investment expertise

- Attorney: Essential for complex transactions and legal compliance

- Insurance Agent: Proper coverage is crucial in California

- Contractors: Reliable vendors for maintenance and improvements

The Million-Dollar Question: Should You Self-Manage or Hire Professionals?

Self-Management Works If:

- You live near your properties

- You have 5 or fewer units

- You enjoy hands-on involvement

- You have time for tenant management

Professional Management Is Better When:

- You own properties more than 50 miles away

- You have a full-time job

- You own 6+ units

- Your time is better spent finding new deals

Common Mistakes That Cost California Investors Thousands

Mistake #1: Underestimating Operating Expenses

Reality Check: California properties often have higher maintenance costs due to seismic requirements, environmental regulations, and premium materials.

Solution: Budget 45-55% of gross rental income for operating expenses in major California markets.

Mistake #2: Ignoring Local Rent Control Laws

The Problem: Cities like San Francisco, Los Angeles, and Berkeley have complex rent control ordinances.

The Solution: Research local laws thoroughly and factor compliance costs into your projections.

Mistake #3: Overleveraging in High-Price Markets

The Risk: High property values can tempt investors to stretch their financing too thin.

The Protection: Maintain debt-to-income ratios under 70% and keep 6-12 months of expenses in reserves.

Mistake #4: Neglecting Natural Disaster Planning

California-Specific Risks: Earthquakes, wildfires, and flooding affect different regions.

Essential Preparations:

- Adequate insurance coverage

- Emergency property protection plans

- Diversified geographic holdings

Your Next Steps: Taking Action in California Real Estate

The 30-60-90 Day Action Plan

Days 1-30: Foundation Building

- Define your investment goals and criteria

- Secure financing pre-approval

- Begin market research on 3-5 target cities

- Connect with local real estate professionals

Days 31-60: Market Deep Dive

- Visit target markets in person

- Analyze comparable rental properties

- Build relationships with local investors

- Refine your investment criteria

Days 61-90: First Investment

- Make offers on qualified properties

- Complete due diligence processes

- Close on your first California investment

- Set up property management systems

Final Thoughts: The California Opportunity Awaits

California real estate investing isn’t for the faint of heart, but the rewards can be extraordinary for those who approach it strategically. With strong demand, rising rental yields, and a thriving multifamily housing market, California remains one of the best places for real estate investment in 2025.

The key to success lies not in timing the market perfectly, but in understanding it deeply, preparing thoroughly, and acting decisively when opportunities arise. As Sarah Chen from our earlier story proves, with the right strategy and persistence, California real estate can transform your financial future.

Remember: “The best time to plant a tree was 20 years ago. The second best time is now.” The same principle applies to California real estate investing. The market will always have challenges, but those who take educated action while others hesitate are the ones who build lasting wealth.

Ready to start your California real estate investment journey? Begin with thorough market research, build your team of professionals, and take that first calculated step toward building your real estate empire in the Golden State.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Real estate investing involves risks, and past performance does not guarantee future results. Consult with qualified professionals before making investment decisions.

Key Takeaways:

✅ California offers 7% average ROI with $800k average property prices

✅ Suburban markets are booming due to remote work trends

✅ Multifamily properties provide excellent diversification

✅ Sacramento and Fresno offer the best cash flow opportunities

✅ San Francisco and Orange County lead in appreciation potential

✅ Proper financing and team building are crucial for success

✅ Tax advantages can significantly boost your returns

What’s your next move in California real estate investing? The opportunity is waiting.