Introduction

Deciding where to buy investment property can make or break your returns, especially in 2025’s rapidly changing real estate market. This data-driven guide reveals the most and least promising states for investors, sharing critical stats, investment insights, and actionable advice to maximize your success.

Why State Choice Matters in 2025

- Economic diversity: State economies range from booming tech hubs to markets facing population loss.

- Rental demand: Varies greatly with local job growth and migration trends.

- Landlord laws and taxes: These impact profitability and risk.

A state’s overall performance, plus key metro area opportunities, should guide your strategy.

Key Metrics to Assess

Evaluate each state on:

- Median home price

- Average rental yield (Annual rent ÷ Home price)

- Population growth rates

- Job market strength

- Landlord-friendliness (laws/taxes)

- Property appreciation forecasts

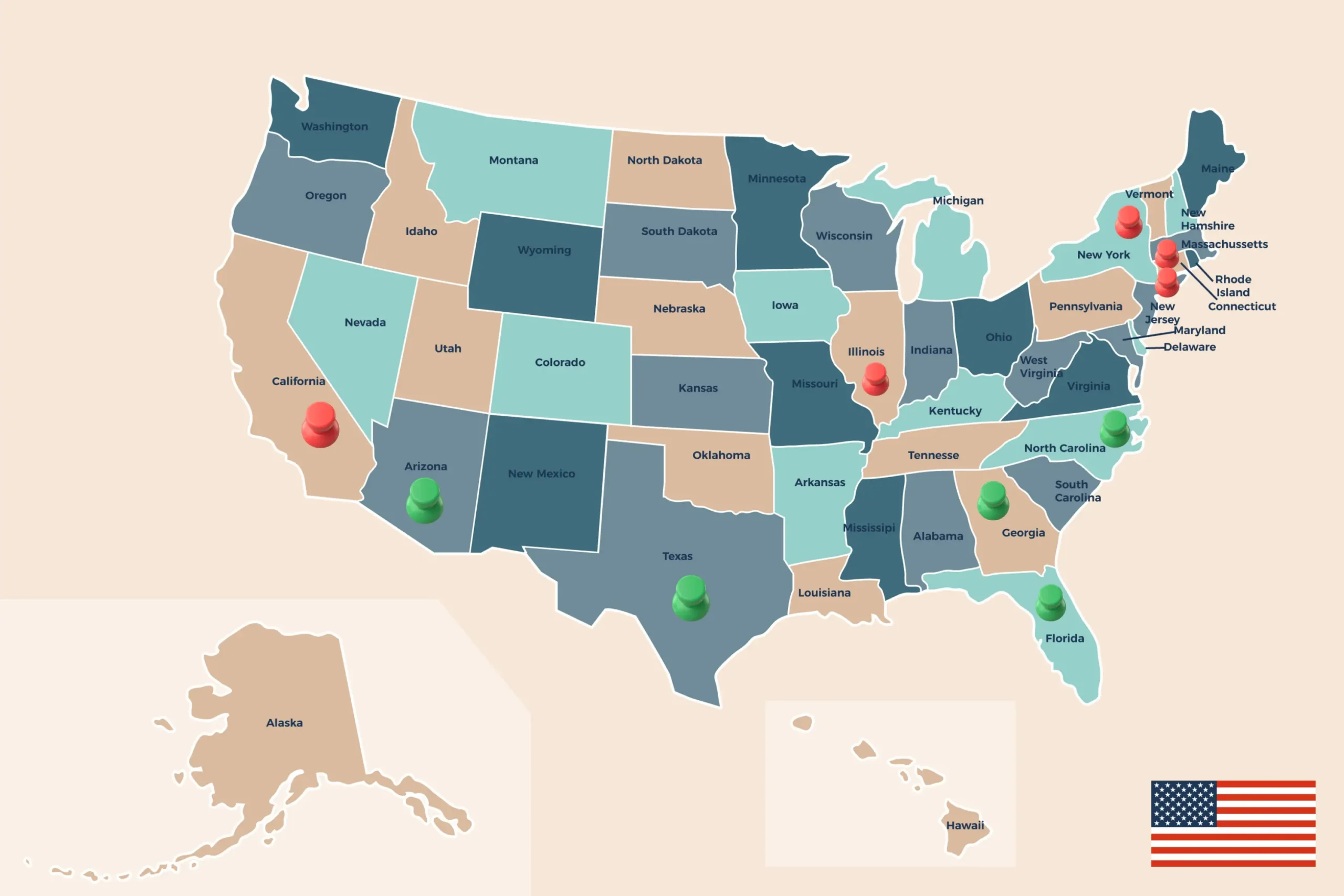

The Best States to Buy Investment Property in 2025

| State | Median Home Price 2025 | Avg. Rental Yield | Notable Cities | Landlord Friendliness | Population Growth |

|---|---|---|---|---|---|

| Texas | $375,000 | 7.2% | Austin, Dallas | Very High | High |

| Florida | $410,000 | 6.9% | Tampa, Orlando | High | High |

| North Carolina | $321,000 | 6.7% | Charlotte, Raleigh | Moderate-High | High |

| Georgia | $298,000 | 6.5% | Atlanta, Savannah | High | Moderate |

| Arizona | $397,000 | 6.2% | Phoenix, Tucson | Moderate | Moderate-High |

Rental yield = (Annual rental income ÷ Property value) × 100%

Why These States?

- Texas: Explosive population and tech sector growth, robust rental demand, and favorable legal climate for landlords.

- Florida: High rental demand from migration and tourism, no state income tax, steady appreciation.

- North Carolina/Georgia/Arizona: Affordability, growing economies, and rising rents further strengthen their investment appeal.

The Worst States for Investment Property in 2025

| State | Median Home Price 2025 | Avg. Rental Yield | Notable Cities | Landlord Friendliness | Population Growth |

|---|---|---|---|---|---|

| California | $799,000 | 3.5% | Los Angeles, SF | Low | Low |

| New York | $642,000 | 3.8% | NYC, Buffalo | Very Low | Negative |

| Illinois | $282,000 | 4.1% | Chicago | Low | Negative |

| New Jersey | $519,000 | 4.2% | Newark, Jersey City | Low | Low |

| Connecticut | $374,000 | 4.0% | Hartford, Stamford | Low | Low |

Why These States?

- High costs: Median home prices far outpace local rents.

- Restrictive laws: Landlords face strict eviction rules and higher taxes.

- Stagnant or declining populations: Weak demand and slow long-term growth.

Noteworthy Local Markets

- Austin, TX: Tech-driven migration and rental booms.

- Tampa, FL: Population influx, competitive rents, tourism resilience.

- Charlotte, NC: Finance and tech jobs fueling demand.

- Atlanta, GA: Entry-level pricing and steady appreciation.

Each of these cities outperforms many state averages.

Rental Yields and Home Price Growth

| State | Rental Yield | Home Price Growth 2024–25 | Landlord Laws |

|---|---|---|---|

| Texas | 7.2% | +4.5% | Favorable |

| Florida | 6.9% | +4.2% | Favorable |

| California | 3.5% | +1.2% | Restrictive |

| New York | 3.8% | +0.8% | Restrictive |

Legal and Tax Considerations

- No state income tax: Florida and Texas help investors retain more profit.

- Strict landlord laws: California and New York have more tenant protections and eviction hurdles.

- Property taxes: Vary by state and can significantly impact net yields.

Consult a local real estate attorney or tax advisor before purchasing.

Actionable Insights for Investors

- Focus on states with:

- Growing populations

- Strong job markets

- Landlord-friendly policies

- Healthy rental yields

- Analyze neighborhood trends—not just state averages—before buying.

- Calculate all ownership costs, including taxes and legal compliance.

Conclusion

Investing in rental property is highly location-dependent, and choosing the right state can significantly impact your returns and risks. In 2025, states like Texas, Florida, and North Carolina stand out with strong rental yields, promising appreciation, and landlord-friendly environments — making them prime targets for savvy investors. Conversely, high-cost states with restrictive laws like California and New York may pose challenges for property investors.

Before making a purchase, always analyze local market conditions, legal considerations, and long-term trends to ensure your investment aligns with your financial goals. For more expert guidance, explore our other resources on real estate market analysis and property management.